There's already plenty of resources online. Specifically, there is this unique priceless PDF that I found on Reddit, which covers pretty much everything in detail.

For French speakers, here is a short video that explains in 10 minutes the steps to buy an apartment in Germany.

But here I wanted to write a summary/short article, with the key facts and steps, about buying an apartment in Berlin. Here we go!

1. Know what you can afford

The one-time payment for the apartment and the side costs

Ask around you. Ask loan brokers. Use online tools, such as this one from Hypofriend.

You must be able to afford the invoices for Notar + Grundbucheintrag (~2% of the price of the apartment), Grunderwerbsteuer (~6%) and Maklerprovision (usually 3,57% in Berlin at the time of writing) with your equity capital/own money (Eigenkapital). The loan can only cover the price of the apartment (Kaufpreis). Up to 100% of the Kaufpreis can be covered by the loan, depending on the bank. You'll get the best interest rates though if you can finance 20% of the Kaufpreis with your Eigenkapital.

A good rule of thumb I have once been told is that most banks will generally accept to finance up to 110 times your monthly net income. Say you earn 3,000 euros net per month, you could in theory borrow up to 330,000 euros.

The monthly cost of being a home-owner in Germany

As the owner of an apartment, you will have to pay the Hausgeld: it's money used for the common parts. It usually varies between 3 and 4 euros per square meter. For each apartment, you can get this piece of information directly on the listing or during the viewing.

On top of that, you need to pay a new tax: the Grundsteuer. It's pretty cheap in Berlin.

2. Make sure you have a SCHUFA Score, that is not too bad

This is especially true if you are a foreigner and do not have a German bank account, or barely use it. N26 can fuck things up and somehow not transmit any data to SCHUFA. Not having a SCHUFA Score is even worse than having a poor score, as some banks will simply not proceed at all with you, not even studying your case, since they can't get any score at all. You can ask SCHUFA to provide you with the data they have about you by invoking the GDPR.

3. The apartment hunt

Start with immobilienscout24. Set an alert to get hourly emails. Discover agencies through the website. Then check those agencies' websites. Here are some:

- www.immo-boerse.com/immobilien/

- www.next-estate.de/de/

- www.engelvoelkersberlin.com/

- bepartofberlin.de/

Set alerts on each website. Be on the lookout for "Vermietet", which means "rented". Surely you don't want to buy an apartment where there's already a tenant with an unlimited contract...

Whenever you see a listing of interest, send an email. After 6 hours without any reply, call them directly. For each apartment, they should send you back a document presenting the property called an "Exposé". Tell them straight away what your availabilities are for a viewing.

4. Go to viewings

If the Exposé does not contain any NO-GO information (like a crazy Energieklasse...), move forward and go to the viewing.

The PDF I mentioned in the introduction has some great pieces of advice as to what to look for. For instance, mold on the walls/ceiling is a no go, just like single-glazed windows are. Pay attention to the Energieklasse. Be quiet for a few seconds, make sure the neighborhood is not noisy (metro, car traffic, trams, schools, etc). Assess how much repair is needed. Ask about:

- Hausgeld

- New owners, old owners, what the WEG (Wohnungseigentümergemeinschaft - homeowner association) is made of.

- Which walls can be torn down

- How freely you can change the windows, doors, etc

- Presence of asbestos (very often found in vinyl tiles (PVC) flooring laid out before 1993, like extremely common)

5. You found one you like? It's in your price range? Reserve it!

This step mostly depends on your Makler. Some will ask for a bunch of papers to sign + ID card copies to send, some others will also want to see a proof that you have fund and a bank backing you up. Unless stated in the PDF aforementioned, I never heard of anyone having to make some down payment/pay a reservation fee ahead.Just reach out to your Makler and ask how to reserve it.

6. Money time: the loan

How to get a loan

You know how much the Kaufpreis of what you reserved is. You should be able to calculate the price you'll have to pay for the Notar, Grundbucheintrag, Grunderwerbsteuer and Maklerprovision (sometimes this one is "free"). You also know your Eigenkapital. Estimate the repair costs (new kitchen, new floor, etc). Do the maths of that all and you'll know how much money you need to borrow.

Now, 2 options:

- Go see the banks yourself

- Use a mortage broker

If your German is good enough and you have plenty of time, 1. is the best option, as you'll likely get the best interest rate. With 2., you will likely get a worse deal, cause even though you don't need to pay the mortage broker, the bank will (the broker usually get a fixed percent of the loan). So in theory, banks will "compensate" without telling you. But with 2., you'll also save a shit ton of time and hassle. Mortgage brokers are experienced, they know how to solve many tricky situations (no Schufa score...). Not to mention that brokers who speak your mother tongue are a HUGE HELP. They can offer additionnal services, such as acting as an official translator during the Notar meeting, probably free of charges.

For expats, Hypofriend has been gaining a lot of traction these past few years, as they offer all their services online and in English. For French speakers, www.connexion-francaise.com and expatriation-allemagne.com/ are good options.

Most banks in Germany will want to secure their investement with a mortage deed (Grundschuldbestellungsurkunde). More on that in the next chapter.

Understand your loan offers

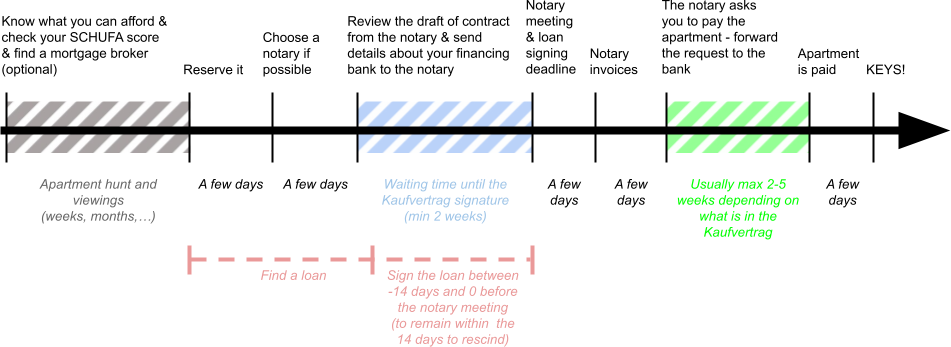

After the loan is signed, you have 14 days to rescind (cancel) it. It is therfore very important to go to the notary to sign the Kaufvertrag (purchase contract) within these 14 days. Otherwise, should the purchase never happen, you would not be able to cancel the loan.

- "Sollzinssatz" is the interest rate.

- "Monatliche Rate" is what you pay each month out of your bank account: this is the sum of the interests and the repayment

- "Tilgungssatz" (also called "Sparrate") is the repayment rate

- "Bereitstellungszinsfreie Zeit" and "Bereitstellungszins" refer to the amount of time the loan can sit unused at the bank, after which you must pay fees (interests). Usually, a loan must be disbursed within 2 or 3 months, afterwards interests are charged.

In Germany, the most common type of loan is with a fixed-interest period (usually 10 or 15 years) after which you can either renegociate a new interest, pay the whole remaining debt back, or continue the loan with another bank (and another interest rate, most likely).

Almost all banks allow exceptional repayments (Sondertilgung) every year, up to 5% of the loan. For instance, the Deutsche Bank allow you those Sondertilgung after the first 12 months in the loan, up to 5% of the loan per calendar year.

You will agree with your bank on a Monatliche Rate, the amount of money that comes out of your bank account every month. In this amount, you pay both interests and debt back. The Monatliche Rate is always the same until the end of the agreed fixed-interest period.

Each month, you will pay back ((INTEREST RATE * REMAINING DEBT) / 12) in interests, and you will pay back (MONATLICHE RATE - INTERESTS PAID) as debt repayment.

For instance, the first month, for a loan of 400,000 euros with an interest of 2%, and a monatlich Rate of 2,000 euros, you will pay

- In interests: (0.02 * 400,000) / 12 = 666.67 euros

- In debt: 2,000 - 666.67 euros = 1333.33 euros

The next month, you will pay:

- In interests: (0.02 * (400,000 - 1333.33)) / 12 = 664.44 euros

- In debt: 2,000 - 664.44 euros = 1335.56 euros

A note on Deutsche Bank

Deutsche Bank will typically open up multiple bank accounts, when you sign a loan with them:

- A Kreditkonto (whose IBAN ends in 00), for you to transfer your equity capital and pay the invoices related to the purchase (notary, etc).

- A "përsonliches Konto" (whose IBAN ends in 05), which you can optionaly open and use to pay the monthly loan repayments and/or the Lebensversicherung (see below), if you ask them. You can also get one Girocard (EC card) for free.

- Another account dedicated to Sondertilgung (whose IBAN ends in 87).

Lebensversicherung/Risikolebensversicherung

Depending on which bank you go with, they might require that you sign up for a Risikolebensversicherung: an insurance that would pay a lump sump agreed on (which decreases over the years), in the event of death. It can covers multiple people, if you're not buying alone. The Deutsche Bank is one of the banks that require such an insurance. The cost varies depending on how much money is covered, but expect to pay between 15 and 40 euros per month.

7. Kaufvertrag (Purchase contract)

While you are reviewing the loan offer, you should start thinking about the Kaufvertrag. If the seller gives you the freedom to pick the notary of your choice, choose one who will also edit a copy of the contract in English.

If you German is not excellent, the notary will probably require that a translator is present during the meeting. Your mortgage broker might be able to take the job. A sworn translator is not always required, as long as the notary is convinced you will understand 100%. Put your translator and the notary in contact.

The notary will typically send the first draft of the contract over email after a few days. Review it thoroughly. Have it translated via DeepL if need be. If you buy with somebody, you might want to officially state in the contract how much each of you owns of the apartment. Tell that to the notary, so that it gets written in the contract. Note that this will impact how the Gunderwebsteuer (the 6% tax) is paid: they will ask that each owner pays the tax pro-rata to what each owns, with two separate payments.

Your notary appointment cannot take place before 2 weeks after the last draft of the contract has been edited (legal requirement).

A few days ahead of the notary meeting, the notary will ask you a bunch of papers from your financing bank, so that they can start writing the draft of the Grundschuldbestellungsurkunde (mortgage deed). Forward that request to your mortgage broker if you have one.

The actual meeting is pretty boring: the notary will read EXACTLY AS WRITTEN first the Kaufvertrag, in the presence of the seller and your translator, and then the Grundschuldbestellungsurkunde only with you and your translator. That's all. Nothing more, nothing less. Expect 2 hours.

8. Payments

A few days later, you will receive various invoices from the Notar (Notarkosten at least, maybe the Grundbucheintrag too).

Another few days later, the Notar will ask you to pay the apartment before a given due date. What you'll most likely do is, transfer your equity capital to some temporary bank account provided by your financing bank. Then, the bank will pay the seller. The bank might ask you to transfer all of the equity capital you said you had, minus what you paid to the Notar already, and then ask you to pay the remaining future invoices (Grunderwerbsteuer at least) from that temporary bank account.

Conclusion: timeline of events

Simulation

Loan needed

| Name | Expenditure | Capital |

|---|---|---|

| Equity capital | ||

| Repair costs | ||

| Sum capital - repair | ||

| Tax (Grunderwerbsteuer 6%) | ||

| Notar (Notarkosten 1,5%) | ||

| Notar (Grundbucheintrag 0,5%) | ||

| Broker commision (usually 3,57%) | ||

| Sum Tax + Notar + Broker commision | ||

| Purchase price | ||

| Total price (Purchase price + Tax + Notar + Broker commision) | ||

| Remaining capital for the apartement alone | ||

| Loan needed |

Profitability comparator

This tool does not take into account the earnings you would have made off savings/stocks if you had not spent that money as down payment.

Tilgungsplan

| Date | # | Repayment | Interest | Total paid this far | Remaining debt | Debt repaid | Interests paid | Sonder-tilgung |

|---|

Great how-to articles about buying in Berlin

In English

In French

- www.goodmorningberlin.com/financer-achat-immobilier-a-berlin/

- aberlin.fr/acheter-un-appartement-a-berlin.php

- guide.mfc.bayern/Acheter_de_l%27immobilier

- www.guidewebimmobilier.com/annonce-immobiliere/achat-appartement-berlin-quil-faut-savoir.html

- expatriation-allemagne.com/categorie/nos-expertises/immobilier/

- www.connexion-francaise.com/vivre-en-allemagne/acheter-un-bien-immobilier-en-allemagne