Most health insurance companies in Germany offer the following things. I took me many years to discover them. Hopefully this will be useful to some.

They reward physical activity and preventive healthcare

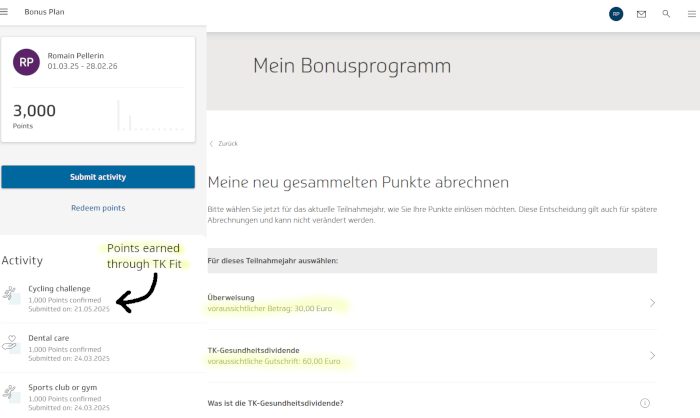

Most insurances offer bonus plans, through which people get "points" for being active but also by taking preventive health actions, such as going once a year to the dentist for a check-up, getting vaccinated, following online nutrition courses, etc. All it takes is "uploading" proofs of these actions (can be as simple as filling out a form with the date of the medical appointment).

Regarding the "being active" part, some insurance can connect to fitness platforms like Garmin, sync your activities and give you points for doing X steps per day, cycling a few kilometers a week, etc. As an example, TK has a program called TK-Fit, which is part of ther bonus plan.

Once you accumulate enough points, you can either "cash them out" (get a money transfer from the insurance) or get total or partial refunds for things that are remotely health-related, such as a gym membership or a smartwatch. As an example, this is what you can get a (partial or full) refund for, from TK.

With TK, 1,000 euros = 10 euros "cashed out", or 20 euros as health dividends. Submit an invoice for a Garmin watch for instance, and get a 20-euro money transfer.

Here is some feedback from TK clients.

Opting out of premiums

Another way of saving money is by opting out of premiums (= options) one does not need, like homeopathy. Again, here is some feedback from TK clients. In most cases, should one still need a type of care they opted out of, they of course would get it and the insurance would pay for most of the costs The only difference is that a part of the costs would have to be paid for by the patient, as opposed to being fully covered by the insurance.